Do You Pay Sales Tax On Used Cars In Missouri . The department collects taxes when an applicant applies for title. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. If you traded in your old vehicle. motor vehicle, trailer, atv and watercraft tax calculator. in missouri, you pay a tax of 4.225% on the actual sales price of your car or truck. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. with privateauto's used car sales tax calculator, calculating sales tax has never been easier. There is also a local tax of up to 4.5%. However, there are an additional 435 local tax. Our free online car sales tax. missouri collects a 4.225% state sales tax rate on the purchase of all vehicles.

from mavink.com

with privateauto's used car sales tax calculator, calculating sales tax has never been easier. Our free online car sales tax. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. If you traded in your old vehicle. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. The department collects taxes when an applicant applies for title. There is also a local tax of up to 4.5%. in missouri, you pay a tax of 4.225% on the actual sales price of your car or truck. motor vehicle, trailer, atv and watercraft tax calculator.

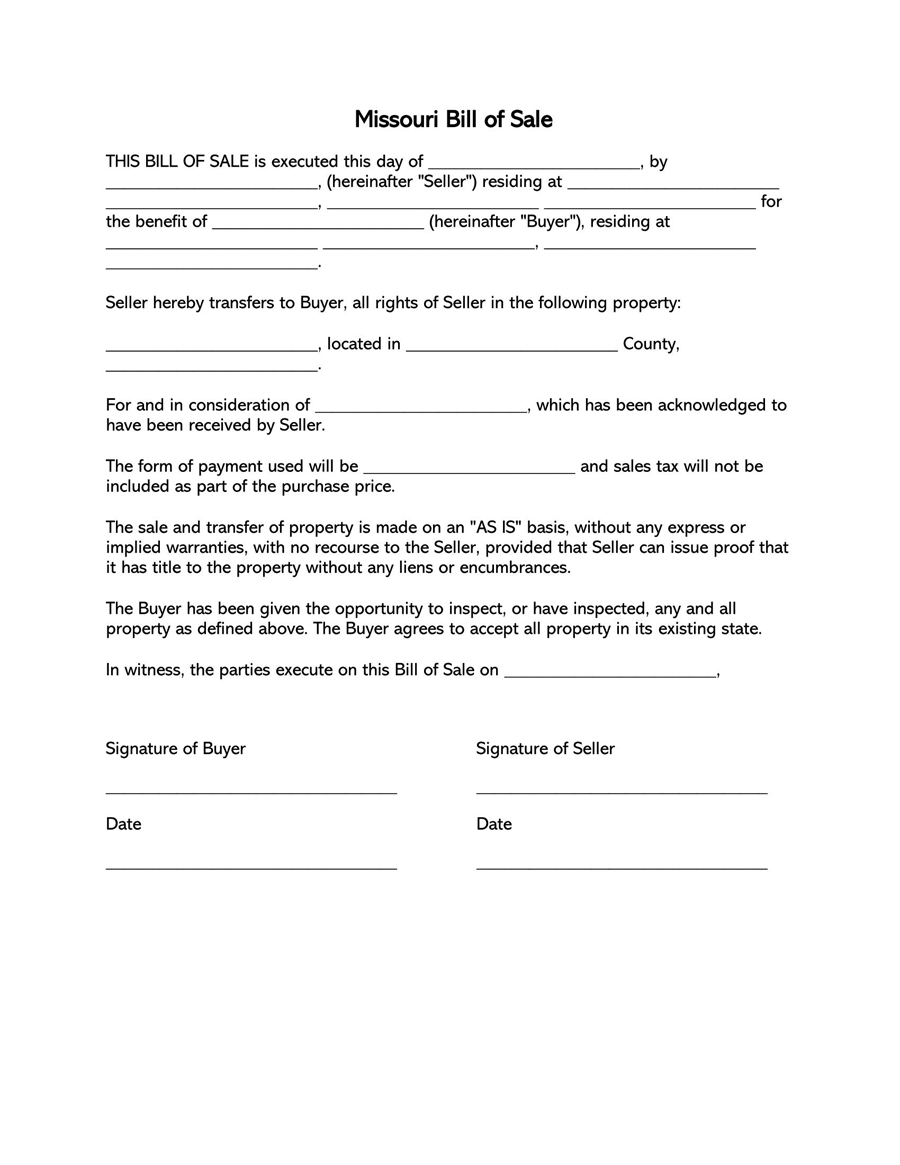

Missouri Auto Bill Of Sale Printable

Do You Pay Sales Tax On Used Cars In Missouri when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. However, there are an additional 435 local tax. in missouri, you pay a tax of 4.225% on the actual sales price of your car or truck. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. motor vehicle, trailer, atv and watercraft tax calculator. There is also a local tax of up to 4.5%. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. The department collects taxes when an applicant applies for title. with privateauto's used car sales tax calculator, calculating sales tax has never been easier. If you traded in your old vehicle. Our free online car sales tax.

From exotdcaor.blob.core.windows.net

Do You Pay Sales Tax On A Used Car From Private Seller In Wisconsin at Do You Pay Sales Tax On Used Cars In Missouri Our free online car sales tax. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. However, there are an additional 435 local tax. There is also a local tax of up to 4.5%. in missouri, you pay a tax of 4.225% on the. Do You Pay Sales Tax On Used Cars In Missouri.

From whoamuu.blogspot.com

Pdf Free Bill Of Sale Template For Car HQ Printable Documents Do You Pay Sales Tax On Used Cars In Missouri The department collects taxes when an applicant applies for title. missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. Our free online car sales tax. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. There is also a local tax of. Do You Pay Sales Tax On Used Cars In Missouri.

From taxfoundation.org

Tax What is an Individual Tax? Tax Foundation Do You Pay Sales Tax On Used Cars In Missouri with privateauto's used car sales tax calculator, calculating sales tax has never been easier. in missouri, you pay a tax of 4.225% on the actual sales price of your car or truck. motor vehicle, trailer, atv and watercraft tax calculator. Our free online car sales tax. However, there are an additional 435 local tax. If you traded. Do You Pay Sales Tax On Used Cars In Missouri.

From piersxybusby46f.blogspot.com

free missouri bill of sale forms 4 pdf eforms free missouri vehicle Do You Pay Sales Tax On Used Cars In Missouri when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. There is also a local tax of up to 4.5%. motor vehicle, trailer, atv and watercraft tax calculator. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state. Do You Pay Sales Tax On Used Cars In Missouri.

From mavink.com

Missouri Auto Bill Of Sale Printable Do You Pay Sales Tax On Used Cars In Missouri The department collects taxes when an applicant applies for title. However, there are an additional 435 local tax. in missouri, you pay a tax of 4.225% on the actual sales price of your car or truck. motor vehicle, trailer, atv and watercraft tax calculator. use the tax calculator to estimate the amount of tax you will pay. Do You Pay Sales Tax On Used Cars In Missouri.

From www.templateroller.com

Missouri Generic Bill of Sale Form Fill Out, Sign Online and Download Do You Pay Sales Tax On Used Cars In Missouri The department collects taxes when an applicant applies for title. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. However, there are an additional 435 local tax. with privateauto's used car sales tax calculator, calculating sales tax has never been easier. Our free. Do You Pay Sales Tax On Used Cars In Missouri.

From www.carsalerental.com

When Do I Pay Sales Tax On A New Car Car Sale and Rentals Do You Pay Sales Tax On Used Cars In Missouri If you traded in your old vehicle. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. with privateauto's used car sales tax calculator, calculating sales tax has never been easier. However, there are an additional 435 local tax. according to the sales tax handbook, the. Do You Pay Sales Tax On Used Cars In Missouri.

From exoljuttk.blob.core.windows.net

Motor Vehicle Department Registration at Craig Brown blog Do You Pay Sales Tax On Used Cars In Missouri The department collects taxes when an applicant applies for title. in missouri, you pay a tax of 4.225% on the actual sales price of your car or truck. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. However, there are an additional 435. Do You Pay Sales Tax On Used Cars In Missouri.

From dl-uk.apowersoft.com

Bill Of Sale Missouri Free Printable Do You Pay Sales Tax On Used Cars In Missouri The department collects taxes when an applicant applies for title. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. There is also a local tax of up to 4.5%. in missouri, you pay a tax of 4.225% on the actual sales price of. Do You Pay Sales Tax On Used Cars In Missouri.

From www.tpsearchtool.com

Free North Carolina Motor Vehicle Bill Of Sale Form Pdf Eforms Images Do You Pay Sales Tax On Used Cars In Missouri If you traded in your old vehicle. missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. However, there are an additional 435 local tax. with privateauto's used car sales tax calculator, calculating sales tax has never been easier. according to the sales tax handbook, the state of missouri imposes a 4.225 percent. Do You Pay Sales Tax On Used Cars In Missouri.

From learningllonerx3st.z21.web.core.windows.net

Nc County Sales Tax Rates 2024 Do You Pay Sales Tax On Used Cars In Missouri use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. motor vehicle, trailer, atv and watercraft tax calculator. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. Our free online car. Do You Pay Sales Tax On Used Cars In Missouri.

From itrfoundation.org

Iowa’s Local Option Sales Tax A Primer ITR Foundation Do You Pay Sales Tax On Used Cars In Missouri If you traded in your old vehicle. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. However, there are an additional 435. Do You Pay Sales Tax On Used Cars In Missouri.

From taxsaversonline.com

Do You Have to Pay Sales Tax on Used Car? Do You Pay Sales Tax On Used Cars In Missouri use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. The department collects taxes when an applicant applies for title. motor vehicle, trailer, atv and watercraft tax calculator. There is also a local tax of up to 4.5%. in missouri, you pay a tax of 4.225%. Do You Pay Sales Tax On Used Cars In Missouri.

From cegrczof.blob.core.windows.net

Cra Tax Forms 2023 Nova Scotia at Martha Pritchett blog Do You Pay Sales Tax On Used Cars In Missouri If you traded in your old vehicle. However, there are an additional 435 local tax. There is also a local tax of up to 4.5%. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. with privateauto's used car sales tax calculator, calculating sales. Do You Pay Sales Tax On Used Cars In Missouri.

From www.template.net

Free Missouri Used Car Bill of Sale Form Template Google Docs, Word Do You Pay Sales Tax On Used Cars In Missouri There is also a local tax of up to 4.5%. However, there are an additional 435 local tax. The department collects taxes when an applicant applies for title. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the purchase of vehicles. in missouri, you pay a tax. Do You Pay Sales Tax On Used Cars In Missouri.

From www.pinterest.com

When you sell a car in Missouri you have to complete a Missouri car Do You Pay Sales Tax On Used Cars In Missouri The department collects taxes when an applicant applies for title. However, there are an additional 435 local tax. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. There is also a local tax of up to 4.5%. according to the sales tax handbook,. Do You Pay Sales Tax On Used Cars In Missouri.

From forms.legal

Bill of Sale Missouri Form For Car, DMV or Standard Sale Do You Pay Sales Tax On Used Cars In Missouri missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. However, there are an additional 435 local tax. with privateauto's used car sales tax calculator, calculating sales tax has never been easier. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. Do You Pay Sales Tax On Used Cars In Missouri.

From exotdcaor.blob.core.windows.net

Do You Pay Sales Tax On A Used Car From Private Seller In Wisconsin at Do You Pay Sales Tax On Used Cars In Missouri missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. motor vehicle, trailer, atv and watercraft tax calculator. when you trade a used car for a new one, the sales tax only applies to the resulting cost when the credit from the. However, there are an additional 435 local tax. according to. Do You Pay Sales Tax On Used Cars In Missouri.